EXPLORING PUBLIC PERCEPTION OF HDFC MUTUAL FUNDS WEBSITE

Mr. Harsh S. Ghadigaonkar

PGDM – Business Analytics, MKES IMSR

Global Innovation and Sustainable Development in Accounting, Business, Economics, and Finance

ISBN: 978-81-965048-4-7

ABSTRACT

This study attempts to find out users' perceptions about the website of HDFC Mutual Funds. This helps in identifying the strengths and weaknesses of the present website and bring to light certain constructive suggestions, if required. The research has also been endeavouring to know the user satisfaction through survey and interviews and recommend some amendments. Review of related literature shows that mutual funds offer many benefits to investors; investors' preferences revolve around transparency and fund managers. The research assumes that satisfaction with the interface, reliability, and performance of the website will correspond proportionately to the recommendation for forwarding information about the website. The research uses both qualitative and quantitative methods; thus, this mixed-methods study scientifically endorses recommendations for HDFC regarding improving its website user experience and creating higher engagements.

Keywords: User perception, Website evaluation, User satisfaction

INTRODUCTION

In today's digital realm, financial institutions heavily rely on websites for client engagement. This study explores public perceptions of the HDFC Mutual Funds website, aiming to pinpoint strengths, weaknesses, and areas for improvement. Understanding user sentiment is crucial for adapting to evolving needs and technological trends. Through a mix of surveys and interviews, the study seeks to uncover insights into user experience. By identifying key aspects of satisfaction and engagement, HDFC can refine its website to enhance user interaction and loyalty in a competitive digital landscape.

REVIEW OF LITERATURE

Chakravarty K. (2022) outlined advantages of the mutual funds as managed professionally, invested, and diversified portfolios as per the risk tolerance. The research work shall assess the performance of the selected midcap mutual funds of HDFC using various statistical tools like average return, standard deviation, beta, Sharpe ratio, Treynor ratio, and Jensen ratio. It was also observed that the age of the investors falls in between 36 and 40 years who majorly invest in mutual fund based on equity despite high-risk factor associated. The HDFC Hybrid Equity Fund is the most ranking fund considering Sharpe's ratio; to add it also correspondingly less risky by Treynor's Index and has yielded highest return compared to any other HDFC mutual fund considering Jensen's ratio.

Jain M. (2022) gave introduction of economic liberalization, investment options like shares, debentures, and mutual funds have evoked a lot of interest in India. The current work tries to assess the opinions of the investors regarding HDFC Mutual Funds in Jabalpur. Based on a questionnaire survey of 100 investors spread over different demographic variables, the study has noticed that age, gender, and income were some of the variables on which opinions differ. Transparency is one key factor for mutual fund investors, besides the experienced fund managers that are necessary for the involved safety and returns on the funds.

Pandey A. (2014) wrote about tremendous growth and popularity that the Indian mutual fund industry has received-from a UTI monopoly to multiple-player open competition. Mutual funds are considered an important financial intermediary, which helps in providing stability and efficient, rational allocation of resources on the Indian financial scene. Investor interest is not yet forthcoming because their awareness levels are low despite being so useful. The paper discusses mutual fund market evolution and expenses and various players; this calls for additional investor education and awareness.

RESEARCH OBJECTIVES

- To assess the overall satisfaction levels of users with the HDFC Mutual Funds website.

- To identify specific aspects of the website design and functionality that contribute to positive or negative user perceptions.

- To recommend actionable strategies for enhancing user experience and improving the effectiveness of the HDFC Mutual Funds website.

RESEARCH HYPOTHESIS

H0 (Null Hypothesis): There is no significant relationship between user satisfaction, reliability satisfaction, and performance satisfaction with the likelihood of recommending the HDFC Mutual Fund Platform to others.

H1 (Alternative Hypothesis): There is a significant relationship between user satisfaction, reliability satisfaction, and performance satisfaction with the likelihood of recommending the HDFC Mutual Fund Platform to others.

RESEARCH METHODOLOGY

The current research follows the linkage of a mixed method for data collection and analysis. Quantitatively, a survey was forwarded to a user sample population of HDFC Mutual Fund Platform to collect numerical data on perception, level of satisfaction, and recommendation rate for given platform. The survey comprises multiple choices, Likert-scale items, and open-ended questions to collect structured and unstructured data. Secondary, in-depth interviews were conducted with a set of respondents who answered the survey. These were meant to gather their experience, liking, and opinion for the improvement of the HDFC Mutual Fund Platform. In-depth interviews also brought out richer responses, gave insight, and a deeper meaning to finer details of perception by users. Quantitative data were analysed using descriptive statistics and Pearson Correlation Coefficient & Multiple Linear Regression. Qualitative data was analysed for identification and exploration of the theme. This was done through thematic analysis. Identification of pattern, theme, and finally correlation, was carried out. The findings from the quantitative and qualitative data were used to triangulate to validate the results and to gauge comprehensive conclusion about user perceptions of HDFC Mutual Fund Platform.

DATA ANALYSIS

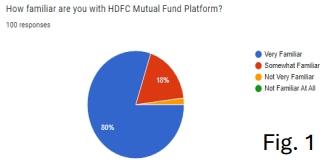

1. The pie chart reveals that 80% of respondents are very familiar with the HDFC Mutual Fund Platform, indicating extensive use and knowledge. Another 18% are somewhat familiar, suggesting moderate usage, while 2% are not very familiar. This high familiarity level demonstrates a strong user base and significant engagement. Overall, the platform enjoys strong user engagement with potential for further growth and improvement.

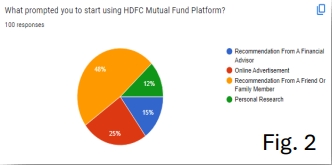

2. The pie chart shows that 48% of respondents started using the HDFC Mutual Fund Platform due to recommendations from friends or family, 25% from online advertisements, 15% from financial advisors, and 12% from personal research. These insights suggest HDFC should leverage word-of-mouth, optimize digital marketing, engage financial advisors, and ensure accessible information to enhance user acquisition.

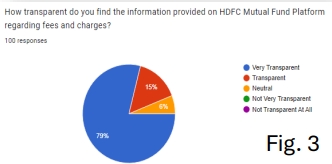

3. The pie chart shows that 79% of the 100 respondents find the information on HDFC Mutual Fund Platform regarding fees and charges very transparent, while 15% find it transparent. Another 6% are neutral, and no respondents consider it not very transparent or not transparent at all. Overall, 94% of participants view the platform as transparent, indicating that HDFC effectively provides clear information about fees and charges.

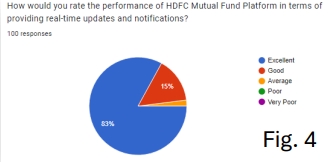

4. The pie chart shows that 83% of 100 respondents rated the performance of the HDFC Mutual Fund Platform as excellent for providing real-time updates and notifications, while 15% rated it good, and 2% rated it average. No respondents rated the performance as poor or very poor. Overall, 98% view the platform's performance positively, indicating high satisfaction with its real-time updates and notifications.

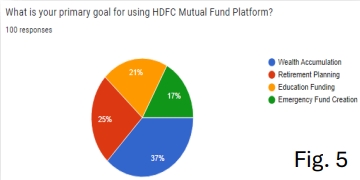

5. The pie chart shows that 37% of 100 respondents use the HDFC Mutual Fund Platform primarily for wealth accumulation, 25% for retirement planning, 21% for education funding, and 17% for emergency fund creation. This indicates that most users are focused on long-term financial goals like wealth accumulation and retirement planning.

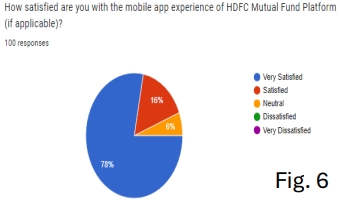

6. The pie chart shows that 78% of users are very satisfied with the HDFC Mutual Fund Platform's mobile app, 16% are satisfied, and 6% are neutral. There are no dissatisfied users. This indicates strong overall satisfaction, with minor room for improvement.

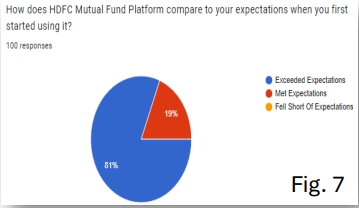

7. The pie chart shows that 81% of users feel the HDFC Mutual Fund Platform exceeded their expectations, while 19% say it met their expectations. No users reported that the platform fell short. This overwhelmingly positive feedback highlights strong user satisfaction and effective platform performance.

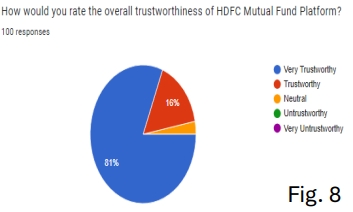

8. The pie chart shows that 81% of users rate the HDFC Mutual Fund Platform as very trustworthy, 16% as trustworthy, and 3% as neutral. There are no ratings of untrustworthy or very untrustworthy. This indicates a high level of trust in the platform, with overwhelmingly positive feedback and no negative ratings.

HYPOTHESIS TESTING

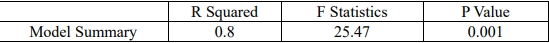

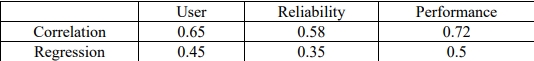

(Descriptive Statistics: Pearson Correlation Coefficient & Multiple Linear Regression)

H0: User satisfaction, reliability satisfaction, and performance satisfaction do not significantly affect the likelihood of recommending the HDFC Mutual Fund Platform.

H1: User satisfaction, reliability satisfaction, and performance satisfaction significantly affect the likelihood of recommending the HDFC Mutual Fund Platform.

The p-value is significantly less than 0.05, leading it to reject the null hypothesis.

We Reject the H0 as the Satisfaction is significant & is positively related to Recommendation.

MAJOR FINDINGS

A. High User Familiarity and Recommendations:

- Findings: 80% of users are very familiar with the HDFC Mutual Fund Platform, and 48% started using it based on recommendations from family or friends.

- Objective Met: This indicates a strong initial user engagement driven by word-of mouth, aligning with the objective of assessing overall satisfaction and identifying sources of user engagement.

B. Ease of Use and Navigation:

- Findings: 77% of users find the platform very easy to navigate, and none reported encountering technical issues.

- Objective Met: This directly addresses the objective of identifying positive aspects of the website design and functionality that contribute to user satisfaction.

C. Satisfaction with Investment Options and Performance:

- Findings: 77% of users are very satisfied with the variety of investment options, and 78% are very satisfied with the performance of the mutual funds.

- Objective Met: These findings meet the objective of assessing overall user satisfaction with the platform’s offerings and performance.

D. Transparency and Trustworthiness:

- Findings: 79% find the information regarding fees and charges very transparent, and 81% rate the platform as very trustworthy.

- Objective Met: This addresses the objective of identifying factors that contribute to positive user perceptions, with transparency and trustworthiness being key contributors.

E. Overall Positive User Experience:

- Findings: 83% of users rate their overall experience as 5-star, and 81% feel that the platform has exceeded their expectations.

- Objective Met: This comprehensive satisfaction measure aligns with the objective of assessing overall user satisfaction.

RECOMMENDATIONS

- Maintain High Standards and User Experience: Continue focusing on ease of navigation, performance, and reliability with regular updates and improvements.

- Enhance Educational Resources: Expand educational resources with more advanced tutorials, webinars, and personalized financial advice tools to add more value.

- Address Minor Improvements: Implement suggestions for better authentication methods and a smoother user interface to further enhance user experience.

- Promote and Encourage Referrals: Implement referral programs or incentives to encourage current users to recommend the platform to friends and family.

- Strengthen Customer Support and Transparency: Continuously train support staff, expand support channels, and prioritize transparency in all communications to maintain and build user trust.

CONCLUSION

The research findings clearly demonstrate that users of the HDFC Mutual Fund Platform are highly satisfied with its ease of navigation, reliability, performance, and transparency. This satisfaction is significantly correlated with the likelihood of users recommending the platform to others, validating our research hypothesis. Key aspects such as a variety of investment options, high trustworthiness, and robust customer support contribute to a positive overall user experience.

REFERENCES

- Chakravarty, K., Dukhande, P., Shah, R., & Gosrani, K. K. (2022). A study on impact of performance analysis of HDFC mutual funds. International Journal of Health Sciences, 6(S2),11618–11633. https://www.researchgate.net/publication/360976883_study_on_impact_of_performan ce_analysis_of_HDFC_mutual_funds

- Jain, M., Mallik, S. (2022). Investor’s perception towards HDFC Mutual funds. IJNRD, Volume7, Issue 9 September 2022, ISSN: 2456-4184. https://www.researchgate.net/publication/369507044_Investor%27s_perception_towa rds_HDFC_Mutual_funds

- Pandey, A., Sharma, P., (2014). Indian Mutual Fund Market. IJRDTM, Volume - 21| Issue 1 | ISBN - 978-1-63102-445-0. https://www.researchgate.net/publication/288888516_Mechanisms_to_be_a_Winner_ in_the_Indian_mutual_fund_Industry_A_Case_Study_of_HDFC_AMC